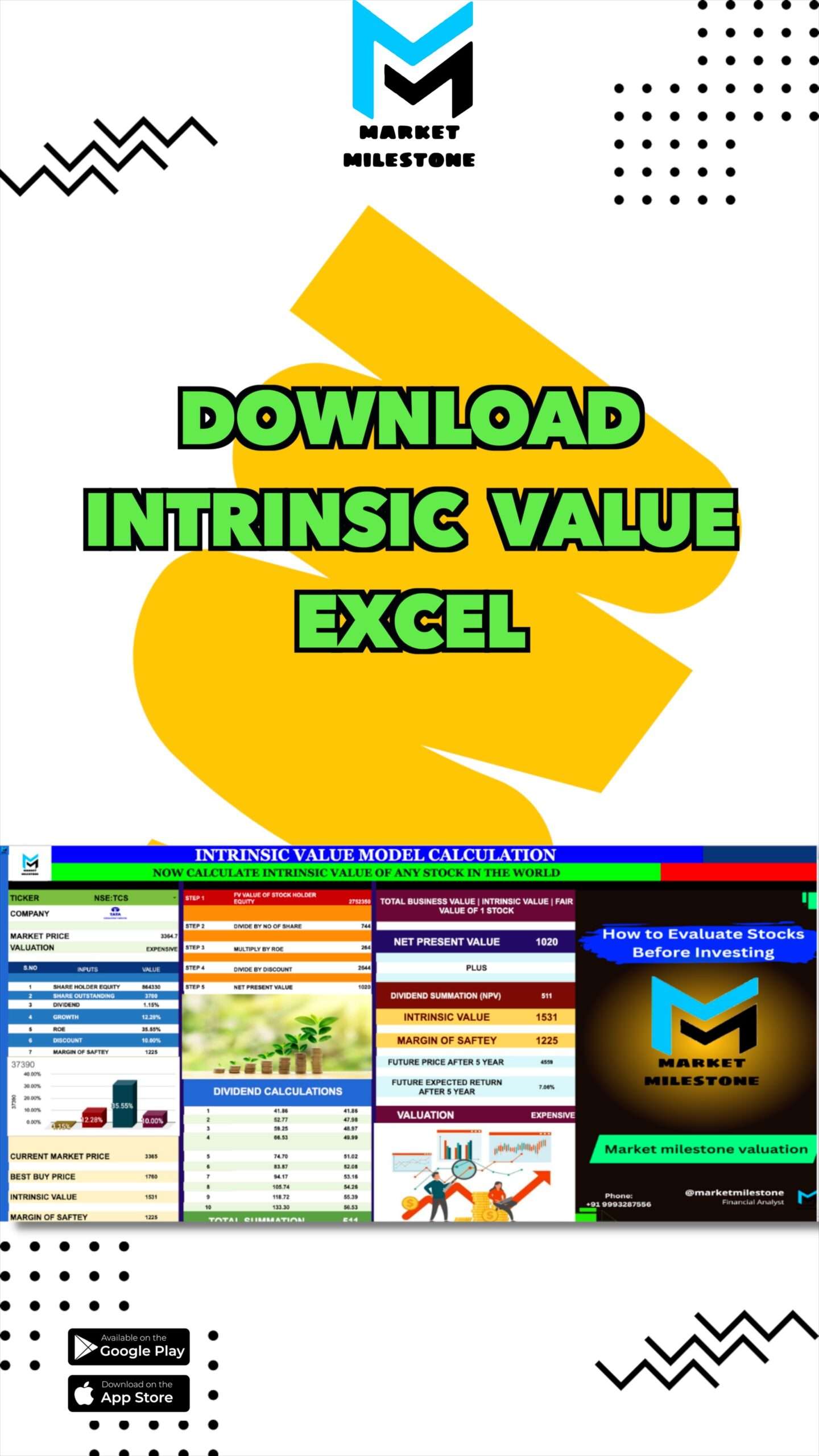

Is it Right to Invest in Stock on its Intrinsic Value

Investing in stocks based on intrinsic value is a common investment strategy that is based on the belief that a stock’s true value can be determined by analyzing its underlying financial and operational factors. Proponents of this strategy believe that by focusing on a company’s fundamentals, they can identify stocks that are undervalued by the market and therefore likely to provide a higher return on investment.

There are several key advantages to investing in stocks based on intrinsic value.

Firstly, it can provide investors with a more rational and objective way to assess a stock’s value, as opposed to relying on market sentiment or speculation. Additionally, by focusing on a company’s underlying financial and operational performance, investors can better understand the long-term prospects for the company and its stock.

However,

it is important to note that determining a stock’s intrinsic value is not an exact science, and there is always a degree of subjectivity involved. This is because there are many factors that can impact a company’s financial performance and stock price, and not all of these factors can be accurately predicted or controlled. Additionally, the market is subject to significant volatility, and changes in investor sentiment can cause stock prices to fluctuate rapidly.

Despite these challenges,

many investors believe that investing in stocks based on intrinsic value can be a profitable and effective strategy, especially for those with a long-term investment horizon. However, it is crucial to do thorough research and due diligence before making any investment decisions, as the stock market is inherently risky and past performance is not a guarantee of future results.

Additionally, it is also important to consider the following factors when investing in stocks based on intrinsic value:

- Diversification: Diversifying your portfolio by investing in a range of stocks from different sectors and industries can help to mitigate the risk associated with investing in any single stock.

- Patience: Investing in stocks based on intrinsic value often requires a long-term investment horizon, as it can take time for the market to recognize the true value of a stock. It is important to have patience and not be influenced by short-term market fluctuations.

- Regular monitoring: Regularly monitoring a company’s financial and operational performance is important for ensuring that its intrinsic value remains intact. Changes in the company’s performance can impact its intrinsic value, and it is important to stay informed about these changes.

- Seek professional advice: For those who are new to investing or are not confident in their ability to assess a stock’s intrinsic value, it may be helpful to seek professional advice from a financial advisor or investment professional.

In conclusion,

investing in stocks based on intrinsic value is a sound investment strategy that can provide investors with the potential for higher returns over the long-term. However, it is important to understand the risks involved and to do thorough research and due diligence before making any investment decisions. Additionally, it is important to consider factors such as diversification, patience, regular monitoring, and seeking professional advice when investing in stocks based on intrinsic value.

investing in stocks based on intrinsic value is a common investment strategy that can provide investors with a more rational and objective way to assess a stock’s value. However, it is important to understand that determining a stock’s intrinsic value is not an exact science, and there are many factors that can impact a company’s financial performance and stock price. As with any investment strategy, it is important to do thorough research and due diligence before making any investment decisions.

Add a comment Cancel reply

Comments (0)

Categories

- Artificial intelligence (4)

- Blogging (1)

- DL Production (10)

- How to Monetize (4)

- News ePaper (22)

- News ePaper English (10)

- News ePaper Hindi (12)

- Personal Finance (3)

- Recipes (1)

- SEO (4)

- TATA ipl (1)

Recent Posts

About us

Popular Tags

Related posts

The Beginner's Guide to Keyword Research for SEO

What are Meta Tags and How to Use Them for Better SEO

Nifty Bank: The Ultimate Digital Banking Experience